Few people plunk down $30K to buy a car. Most purchases of automobiles are through monthly payments over five years to spread out the cost.

In the last few years, online sellers have been catching on to this approach to selling goods (and services), breaking down purchases into monthly or quarterly payments. This idea has been around for years – see as an example any infomercial selling you the latest gadget for six easy payments of $19.99.

But something is changing in the world of commerce. More and more sites are leveraging these payments methods to make it easy to click BUY NOW.

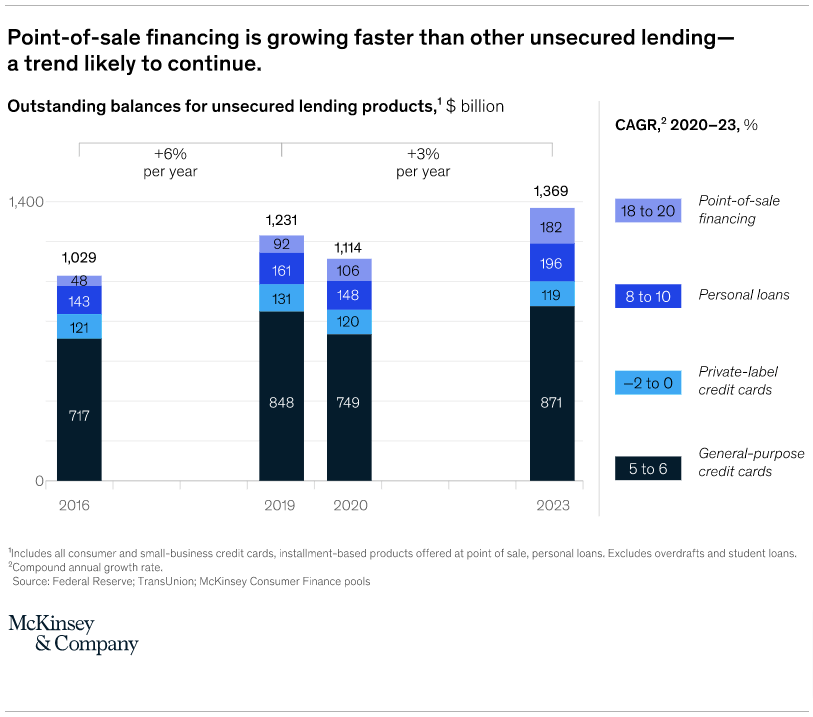

According to McKinsey, credit originating at point of sale (or “BNPL credit”) represented only seven percent of unsecured lending balances in the US in 2019.

Estimates are that this figure will grow to 15% by 2023, making it the only form of unsecured lending to increase during the pandemic – in double digits, Consumers get it – and want it. The Ascent found demand rocketing to over one-third of all consumers, especially Millennials and Gen Z.

Clothing has become the leading form of BNPL activity, but expensive items like TV, furniture, consumer electronics products and expensive appliances are also seeing a boost in sales from this new payment method.

How Do BNPL Companies Make Money?

Merchants usually pay a BNPL charge ranging from 2 to 8 percent of the purchase amount. Some providers also charge a flat fee of 30 cents per transaction. BNPL companies, like Credit Card issuers, pay the vendors in full and then recover money from the customers.

Pay-later plans are particularly popular with millennial and Gen Z shoppers. While BNPL is typically interest-free, some providers charge high late payment fees. BNPL providers say they have safeguards to ensure users don’t overspend.

Consideration About Adding BNPL Option To Your Site?

- OPTIONS: There are many options for plugins to help you, like Splitit. These are relatively easy-to-install options for e-commerce sites. Make sure you research a few to see what plugin gives you the best deal.

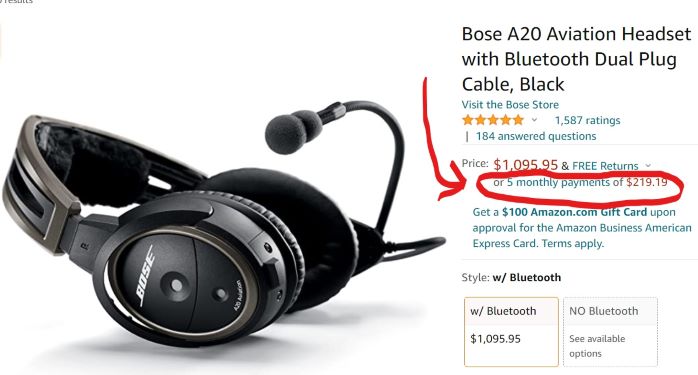

- HIGH TICKET PRICE: It helps have a high enough retail price to make installing a BNPL option worthwhile. An average consumer spending $100 on a purchase may find four monthly $25 easier to accept. If you are selling luxury items that are several hundred or several thousand, you are using a form of a layaway plan that allows an impulse purchaser to click YES.

- GROWTH IN SALES: Splitit claims they see a 20% lift in average order size and a -10% decrease in cart abandonment. Those are significant improvements in profitability when your CAC (customer acquisition cost) is affected by higher sales volume.

Call it what you like – BNPL, layaway plans, or monthly installment payments process.

The key is that removing friction from a purchase encourages a sale. And if you are trying to make it easy for someone to buy, then the psychology of a lower out-of-pocket cost makes sense.

You can set up a time to chat with me about your marketing challenges using my calendar. Email me jeffslater@themarketingsage.com Call me. 919 720 0995. The conversation is free, and we can explore if working together makes sense. Watch a short video about working with me.

Photo by Bruno Kelzer on Unsplash