Three years ago, I wrote this post about Brandless, the online store selling unbranded products. I was curious about their experiment to see if it would succeed. Their approach was disruptive, but also testing a curious question for marketing finks like me – how valuable is a brand? Could they sell consumer goods without a brand? Is there a brandless lesson to be learned?

Well, the answer to Brandless is now clear. They are shutting down.

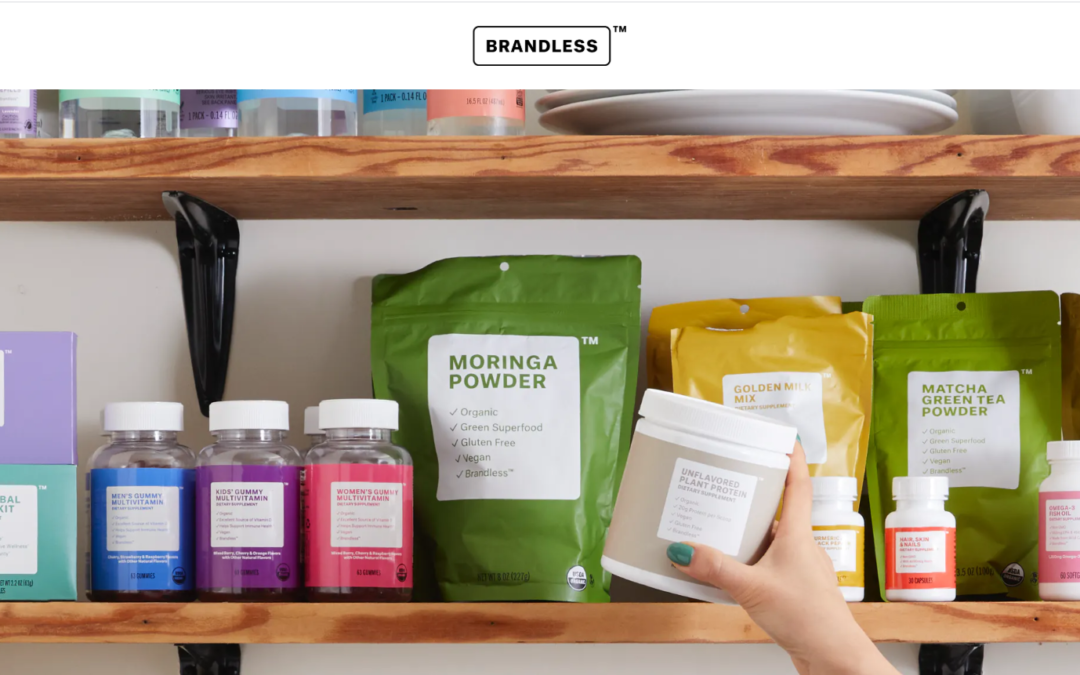

The household products, personal care, baby and pet products were inexpensive and sold under the Brandless brand. (Think private label).

Their disruptive business may have failed, and in part, because they took in so much investment capital, they had to become profitable overnight. The brandless lesson is so counterintuitive.

What happened?

It is a crowded e-commerce world. The value model for an unbranded product doesn’t factor in the emotional and illogical way we buy stuff. We chose one brand over another for reasons that we can’t explain. Coupled with that issue, their business model just wasn’t sustainable. Read what they said on their website.

Did I mention that they raised 260 million dollars from SoftBank?

SoftBank are the folks who recently lost their shirt on their WeWork investment too. With so much money invested in the business, the pressure to succeed was unrealistic in a short time frame.

The CEO, Tina Sharkey, resigned last March as SoftBank pushed hard for them to turn a profit. Being profitable is tough when you are selling goods for $3 a pop and, your product isn’t that differentiated.

Sharkey’s original thesis was that consumers pay a “brand tax,” which can be 40% of a product’s price.

Because they took such a sizeable investment, their window to build a profitable business was accelerated. And, the business couldn’t stand the financial pressure to grow, be profitable, and meet the challenges in the marketplace.

Public Goods

At the same time, a competitor showed up called Public Goods, who only took 3 million dollars in investment. They had the luxury of growing slowly. PG (cleverly like P&G), had one version of each item they sold like shampoo or toothpaste. Whether they can break through and create a brandless product remains to be seen.

There is a marketplace for generic products because they scream value. Do you remember NO-AD suntan lotion? Their thesis in 1962 was the same as brandless – except they focused on one category and sold through conventional channels. They also didn’t take an equity infusion of a gazillion dollars.

Private Label and Grocery Channels

But even grocery stores and their private label brands mimic what consumer brands do in delivering quality goods but at a lower price than traditionally marketed consumer package goods.

365® from Whole Foods or Kirkland Signature from Costco are great examples. They are brands – with an image, but they come from retailers who own channels of distribution. And, it is when a 365 product sits next to a brand from a conventional brand that you can see the dilemma the consumer experiences. Buy a cheaper store brand or buy the national product.

How important is a brand?

The best way to know the answer to this is to watch your behavior when you choose between national brands and store brands. Perhaps you feel comfortable buying store brand paint but not store brand headache remedies. The brandless lesson is so helpful when you are starting a business.

Brands are, in part, image how they make you feel. Store brands are most often selling value and a lower price.

Your decision to buy one over another is both logical and illogical at the same time. But to the entrepreneur, beware of having too much money invested early on. You and your investors may not be aligned on how much time you have to become profitable.

Does your business need a marketing coach, guide, or sherpa? Are you generating enough leads? Is your marketing underperforming? I can help.

You can set up a time to chat with me about your marketing challenges using my calendar. Our initial conversation is free. You talk, I listen. Email me jeffslater@themarketingsage.com or call me. 919 720 0995. Visit my website at www.themarketingsage.com Let’s explore working together today.

Photo courtesy of Brandless, all rights reserved.

Is the problem really because Brandless took so much funding so soon or is the real problem is that Softbank is under pressure to show some of its investments are profitable after WeWork imploded? Softbank made some other big investments like Uber that are not performing well. It also invested in Flexport, which appears to be labor-intensive if you read glassdoor reviews by employees (thus will eventually need to watch its cost and I believe, will take a while for it to be profitable as well).

Lilly, Thanks for your comments. I think the branding issue is compounded by the need that Softbank had to quickly turn a profit. But Brandless always struck me as a product that would have a challenge in the private label or store brand category because they weren’t attached to an existing brand. 365 is attached to Whole Foods Markets. Brandless was unattached and although communicated value – there $3.00 pricing model may have fallen short. Thanks for weighing in on this post. – Jeff